If individual assets and accounts are trees, the general ledger is the forest. It’s a finance team’s master document that shows all of the business’ transactions—accounts payable and receivable, cash on hand, capital assets, inventory, investments, liabilities, equity, and more.

The technology underpinning the general ledger has come a long way from the iconic leather-bound book with rows of neatly scribed figures. Here’s why finance teams should revisit the role of the GL, best practices to break out of the static ledger mold in favor of a dynamic model, and ways to draw out new insights that can inform business strategy in a fast-moving world.

What Is a General Ledger (GL)?

A general ledger is a record of all of a company’s, and its subsidiaries’, assets, liabilities, expenses, income, and equities. General ledgers are generally broken down into records of accounts and account balances and financial transactions and from there, if necessary, into subledgers. How many categories and subledgers are used depends on the complexity of the company’s financial structure.

Key Takeaways

- Without accurate information in the ledger, all other accounting processes and their outcomes are suspect.

- A well-kept general ledger is the foundation of good accounting practices.

- While keeping a GL accurate and up-to-date takes effort, the return is real-time insights for the business.

General Ledger Explained

The general ledger summarizes a company’s financial position. It’s the single, agreed-upon record of data for accounting teams tasked with ensuring the books balance, providing status updates on the company’s cash position, recording the information needed for financial statements and kicking off audit trails.

Controlling Accounts vs. Subsidiary Ledger

In business accounting, controlling accounts and subsidiary ledgers serve distinct but complementary roles. A controlling account in the general ledger shows a specific transaction category’s total balance. Subsidiary ledgers, on the other hand, maintain detailed records of individual transactions that comprise the controlling account’s total. For example, the accounts receivable controlling account displays the total amount that all customers owe at a given time, while its subsidiary ledger tracks each customer’s specific invoices and payment history in greater detail. This two-tiered system allows analysts to access either high-level financial reporting or more granular transaction tracking as needed. To ensure accurate financial record keeping, accountants must regularly reconcile these two ledger types and address any inconsistencies between them.

Importance of the General Ledger in Accounting

Accurate, complete data is the foundation of the forecasts, projections, and statements that accountants use to demonstrate the company’s financial health to management, leaders, funders, potential buyers, auditors, and other stakeholders. Here are four primary ways that general ledgers maintain this essential data.

- Provides an audit trail: Every transaction recorded in the general ledger creates a clear path for auditors to verify financial accuracy over the given period. Additionally, analysts use individual journal entries to drill down into specific transactions and ensure that proper controls are in place to demonstrate regulatory compliance and financial transparency.

- Helps prepare financial reports: The general ledger serves as the bedrock for critical financial statements, including balance sheets, income statements, and cash flow reports. Stakeholders use these statements to gain deeper insights into the company’s financial position, performance, and ability to meet its obligations.

- Identifies discrepancies: Through regular general ledger reconciliation, analysts can spot and address errors, unusual patterns, or potential fraud quickly. This proactive oversight allows businesses to maintain the integrity of accounting records and prevent small issues from becoming major problems.

- Tracks financial health: By maintaining a comprehensive transaction record, the general ledger provides real-time visibility into financial status. This data-driven approach helps companies effectively track the impact of financial strategies over time, informing future decisions. And for long-term strategic planning, business leaders can use this historical data to assess risks and set realistic targets.

Components of a General Ledger

A comprehensive understanding of the financial ecosystem of an organization necessitates a deep dive into the components of its general ledger. The GL possesses several integral elements that contribute to how thorough and comprehensive it is. Here’s a structured exploration of the primary components:

Types of Accounts in the General Ledger

Within the general ledger, accounts are categorized to systematically track and manage financial data. Here are the principal types of accounts in the general ledger:

- Asset accounts: These represent resources owned by the company which have future economic value. Examples include cash, accounts receivable, inventory, and tangible assets like buildings and equipment.

- Liability accounts: These are the obligations or debts that a company owes to other businesses. Common liabilities include accounts payable, loans, bonds, and other financial commitments.

- Equity accounts: These accounts provide insights into the ownership interest of shareholders. Common equity accounts include common stock, retained earnings, and additional paid-in capital.

- · Operating revenue accounts: These capture the income generated from the company’s primary operations, like sales or service fees. Revenue accounts give insights into business activities that drive earnings.

- Operating expense accounts: These record all costs incurred during operations. This includes salaries, rent, utilities, depreciation, and other operational expenses.

- Non-operating revenue accounts: These are revenues earned by a business outside of its main or operations, like investment income or gains from selling equipment.

- Non-operating expense and loss accounts: Like non-operating revenues, non-operating expenses are business expenses not related to a company’s core operations. Examples of this type of account would be interest payments or other one-time losses from activities like restructuring or charges on obsolete inventory.

These account categories form the foundation of a company’s critical financial statements. The balance sheet holds the assets, liabilities, and equity, while the income statement accounts include operating revenues and expenses as well as the non-operating revenues and expenses.

Debits and Credits and the Double-Entry System

The entire structure of the modern accounting system is built on the idea of debits and credits. To understand the complexities of the general ledger, businesses must have a firm grasp of these two components and how they establish a sort of financial balance. At the most basic level, debits and credits are just the left and right sides of a transaction. They serve as the accounting language, dictating how transactions adjust accounts within the general ledger.

The genius of the double-entry system lies in its self-balancing nature. For every transaction, the total debits must equal the total credits, ensuring that the accounting equation (Assets = Liabilities + Equity) remains in balance. This dual-entry acts as a check-and-balance mechanism, minimizing errors and maintaining the integrity of the financial data. Here’s an example:

| Double-Entry Ledger | ||||

| Date | Account | Description | Debit | Credit |

| Jan 1st | Cash | Equipment purchase | $75,000 | |

| Equipment | $75,000 | |||

| Jan 8th | Accounts payable | Inventory purchase on credit | $25,000 | |

| Inventory | $25,000 | |||

| Jan 21st | Cash | Loan | $15,000 | |

| Notes payable | $15,000 | |||

| Total: | $115,000 | $115,000 | ||

Every transaction that a business undergoes will find its way into the general ledger through the lens of debits and credits. Entries in the GL start as journal entries, which, when posted, affect the balances of the respective accounts. Over time, the accumulation of these debit and credit entries shapes the financial narratives portrayed in financial statements.

Account Balances

The account balance represents the net value in an account at any given point in time. It’s derived from the total debits and credits applied to that account since its inception or the start of a financial period. If debits exceed credits in a particular account, it has a "debit balance." Conversely, if credits surpass debits, it has a "credit balance." Account balances are indispensable when crafting financial statements. The balance sheet, for instance, is a direct representation of the balances in asset, liability, and equity accounts. Similarly, the income statement is constructed from the balances in revenue and expense accounts.

Analyzing account balances aids stakeholders in gauging the financial health, liquidity, and performance of an organization. For instance, a dwindling cash account balance might signal potential liquidity issues, while steadily increasing revenue account balances could indicate robust business growth.

Periodic reconciliation of account balances, especially key accounts like cash, is essential. This process ensures that the recorded balances align with external records (like bank statements) and are free from errors or discrepancies.

Auditors extensively review account balances as part of their assurance processes. They assess the accuracy, compliance, and legitimacy of the balances, ensuring they’ve been reported in line with accounting standards and principles.

Chart of Accounts

Closely intertwined with the general ledger, the chart of accounts (CoA) serves as the structural framework that classifies, organizes, and displays the myriad financial accounts that encapsulate a business’s financial transactions and positions.

Essentially, the CoA is a categorized list of all ledger accounts that a business utilizes in its operations. It’s the blueprint that guides the recording of transactions in the general ledger. Each account within the chart has a unique identifier, often numerical, to facilitate quick referencing and data management.

Typically, a CoA is segmented based on the nature of accounts, starting from assets, liabilities, and equity to revenues and expenses. These main categories can further branch into subcategories, like current assets, long-term liabilities, etc. Within these categories, individual accounts are listed, such as cash, accounts receivable, common stock, sales revenue, or rent expense.

The CoA and the GL are inseparable in many ways. While the CoA provides the structured listing of accounts, the GL contains the actual debit and credit transaction entries corresponding to these accounts. Together, they form the complete picture of a business’s financial activities and positions.

Four Main Functions of the General Ledger

The general ledger performs a myriad of functions, each vital to the accurate and efficient financial management of an organization. Its role transcends mere record-keeping; the GL is the linchpin that ensures the financial soundness of an entity. Let’s explore the GL’s four main functions.

1. Recording All Financial Transactions

Every financial activity, whether it’s a purchase, sale, payment, or receipt, finds its way into the GL, which chronologically and systematically captures these transactions to ensure none slips through the cracks. By documenting every monetary move, the GL provides the raw data that becomes the bedrock for subsequent accounting analyses and reports.

2. Serving as a Central Repository for Accounting Data

The GL consolidates all financial data, eliminating the need to sift through disparate records. It streamlines information access and simplifies financial review processes. Given its central role, the GL is typically designed with robust safeguards to prevent unauthorized alterations, ensuring the purity and reliability of financial data.

3. Facilitating the Creation of Financial Statements

Accountants use the information in the general ledger to create accurate and up-to-date financial statements for the given period. The three primary statements are:

- Income statement: By collating revenue and expense accounts, the GL aids in determining an entity’s profitability over a specific period.

- Balance sheet: The GL’s asset, liability, and equity account balances are synthesized to produce a snapshot of an organization’s financial position at a given point in time.

- Statement of cash flows: By tracking cash-related transactions, the GL facilitates the creation of this statement, outlining the cash inflows and outflows from operating, investing, and financing activities.

4. Assisting in Audit and Compliance Activities

With its detailed and transparent record of transactions, the GL serves as a primary reference for auditors, making the audit process more efficient and precise. For many entities, especially those in regulated sectors, the GL ensures that financial data is maintained in adherence to specific standards, aiding in compliance with legal and regulatory mandates.

The general ledger, while an accounting mainstay, is more than just a ledger. It’s the financial compass of a business, directing and informing a multitude of financial processes and decisions. By diligently performing its diverse functions, the GL stands as an irreplaceable instrument in the orchestration of sound financial management.

How a General Ledger Works

The general ledger is an integral component of a company’s accounting system, serving as the central repository for all financial transactions. Its effective functioning is vital for accurate financial reporting and insightful business analysis. Here’s a systematic breakdown of how a general ledger operates.

- Recording transactions: At the heart of the general ledger is the recording of every financial transaction made by the company. These transactions are first documented in journals, capturing both the debit and credit aspects, in line with the double-entry accounting system.

- Classifying data: Once recorded, transactions are categorized into specific accounts, such as assets, liabilities, equity, revenues, and expenses. This classification ensures that data is organized systematically and can be easily retrieved or analyzed.

- Posting: After categorization, data from the journal entries is transferred or "posted" to the respective accounts in the general ledger. This process consolidates data, giving businesses an aggregated view of each account’s activity.

- Trial balance preparation: Every so often, a trial balance is pulled from the general ledger. This step involves tallying the debit and credit entries for each account to ensure they balance out. Any discrepancies indicate errors that need to be fixed for accurate financial statements.

- Adjusting entries: At the end of a financial period, certain entries may need adjustments for events that haven’t been recorded yet, like accrued expenses or revenues. These adjusting entries make certain the ledger reflects the accurate financial position and performance of the company.

- Generating financial statements: With all transactions recorded, classified, posted, and adjusted, the general ledger provides the foundation for preparing the company’s primary financial statements: the income statement, balance sheet, and cash flow statement.

- Audit and review: Because it holds all of a company’s financial information, the general ledger is also a primary source of information during internal reviews and external audits. Auditors use the GL to verify the accuracy and integrity of financial data. In essence, the general ledger ensures transparency, accuracy, and compliance in financial reporting.

In essence, the general ledger functions as the backbone of a company’s financial infrastructure, ensuring transparency, accuracy, and compliance in financial reporting. Proper management and maintenance of the GL are paramount for any business aiming for financial robustness and informed decision-making.

Maintaining and Updating a General Ledger

The general ledger functions as the central repository for recording all financial transactions for a business. Its accurate maintenance and timely updates are key to ensuring a clear and true representation of an organization’s financial health.

Journal Entries

Journal entries are the initial recordings of financial transactions in the accounting system. Each entry typically has a date, accounts affected, amounts to be debited or credited, and a brief description. These entries serve as a chronological record, capturing every financial event as it occurs. They form the foundational basis from which subsequent accounting activities, like posting to the GL, are derived.

Posting: Transferring Information from Journals to the GL

Once a transaction is journaled, the next step is to transfer (or post) these entries to the respective accounts in the GL. Posting translates individual transactions into aggregated data, facilitating a holistic view of each account’s activity and balance. This step ensures that the GL remains up-to-date and reflective of all business transactions.

Trial Balance: Checking for Discrepancies and Errors

A trial balance is a statement that lists down all the ledger accounts along with their respective debit or credit balances at a specific point in time. Its primary aim is to ascertain that the total debits equal the total credits, ensuring adherence to the double-entry accounting principle. Any discrepancy in the trial balance can indicate errors, either in journaling or posting, necessitating a thorough review and rectification.

Adjusting Entries: Reasons and Examples

Not all financial events are immediately journaled or posted. Some transactions, like accrued expenses or prepaid revenues, may require adjustments to reflect their true economic impact accurately.

- Accrued expenses: If a business has utilized services (like utilities) but hasn’t been billed by month-end, an adjusting entry ensures that the expense is recorded in the correct period.

- Prepaid revenues: If a customer pays in advance for services to be rendered in the future, an adjusting entry will recognize the revenue as it’s earned over time.

Adjusting entries ensure the financial statements adhere to the accrual accounting principle, representing an accurate portrayal of financial activities during a period. In essence, the meticulous process of maintaining and updating a general ledger safeguards the integrity and accuracy of a business’s financial records. By understanding and implementing each stage—from journaling transactions to making necessary adjustments—businesses can ensure they produce financial statements that are both compliant and informative.

7 Steps in the General Ledger Reconciliation Process

General ledger reconciliation is a key part of closing the books. Accounting teams must regularly verify that GL entries are accurate by reconciling account balances with supporting documents, such as monthly bank statements.

It involves comparing GL account balances with external statements or independent records to identify and resolve any discrepancies. Through this process, businesses can guarantee that their financial statements provide a true and fair view of their financial position.

Businesses should reconcile the general ledger on a regular basis so that errors don’t compound, following these steps:

- Preparation

- Gather data: Start by gathering all financial documents, including bank statements, invoices, receipts, and other important external records.

- Access the GL: Securely access the general ledger to record the balances and transaction details for the accounts to be reconciled.

- Comparison

- Match transactions: For each transaction in the external document, find its counterpart in the general ledger. For example, when reconciling bank accounts, compare each bank statement transaction with the ledger entries.

- Identify discrepancies: Highlight any differences between the general ledger and external records -- a missing transaction, a difference in transaction values, or a transaction recorded in the wrong account.

- Investigation

- Analyze disparities: Scrutinize any discrepancies to identify the underlying cause. This might involve speaking to relevant departments or personnel or reviewing transaction documentation.

- Identify common discrepancies: Common issues may stem from data entry errors, timing differences (e.g., outstanding checks in bank reconciliations), or missed transactions. Adjustment Journal Adjusting Entries: If legitimate discrepancies are found that are not due to timing differences, prepare journal entries to adjust the GL accordingly.

- Adjustment

- Make journal-adjusting entries: If legitimate discrepancies are found that are not due to timing differences, prepare journal entries to adjust the GL accordingly.

- Prepare documentation: Ensure that any adjustments made are well-documented, providing a rationale for the change and referencing any supporting evidence.

- Verification

- Rerun the trial balance: After adjusting, produce a new trial balance to ensure that the books are still balanced (total debits equal total credits).

- Reconfirm: Re-check the reconciled account against the external record to confirm that the discrepancies have been aptly addressed.

- Documentation and Review

- Compile reconciliation reports: Create detailed reports that show the initial discrepancies, the investigation process, adjustments made, and the final reconciled balances.

- Conduct supervisor review: Ideally, reconciliations should be reviewed and approved by a supervisor or a different team member for an added layer of control and verification.

- Periodic Follow-up

- Perform regular reconciliations: Depending on the nature and volume of transactions, determine the frequency of reconciliation (e.g., monthly, quarterly). More critical accounts, like cash, might require daily or weekly reconciliation.

- Monitor continuously: Implement systems or tools that can flag potential issues in real-time, enabling timely interventions.

The general ledger reconciliation process plays a pivotal role in maintaining the financial integrity of a business. By ensuring it accurately reflects real-world transactions and balances, companies can instill confidence among stakeholders and comply with regulatory and audit requirements. It’s a meticulous process that, when done effectively, safeguards the business against potential financial misrepresentations and inaccuracies.

7 Reasons Businesses Need a General Ledger

Businesses with solid record-keeping practices are better able to provide insights into their financial status and will likely enjoy a higher valuation and easier audits. A complete general ledger is a foundational element of accounting.

- Financial transaction accuracy: A general ledger is used to record transactions and statistical data for a business, and some systems with unified data models connect those transaction details to information about customers, orders, and inventory. Tracking this information helps plan business needs such as inventory purchases, how to price products, and how the business will finance those needs.

- Balancing books: Above all, a general ledger ensures that the books balance. The trial balance makes sure accountants can spot any mistakes and fix them, as well as catch fraudulent activities before they become major issues.

- Ease of filing taxes: Good bookkeeping is essential to making sure the business is making payments for business licenses and insurance necessary for tax compliance. It makes sure all financial information is correct for accurate financial statements that enable the business to make financial projections and plan. It gives the business the detailed information needed for tax purposes and a paper trail in the case of an IRS audit.

- Identifying and stopping fraud: Keeping good financial records helps the business identify fraudulent transactions and remedy them before they become major issues.

- Holistic financial view: The GL aggregates every financial transaction, offering a comprehensive view of the business’s finances across different timeframes. It’s the source from which balance sheets are crafted, detailing assets, liabilities, and equity of a business at any given moment. Through the GL, businesses can ascertain revenue trends, cost structures, profitability metrics, and more, allowing for a deep understanding of operational successes and challenges.

- Strategic planning and decision-making: The general ledger provides data for businesses to grow their financial and strategic reach. Whether it’s about launching a new product, scaling operations, or managing costs, the financial insights from the GL play a crucial role. Businesses can also identify financial vulnerabilities, such as declining revenues or increasing liabilities, and proactively devise strategies to mitigate them. Past financial data from the general ledger helps businesses project future financial scenarios, enabling businesses to plan with greater precision.

- Ensuring transparency and accountability: Every entry can be traced back to its origin, providing a transparent trail of all financial activities. This concept of traceability is vital during external audits and internal reviews . Many industries are subject to strict financial regulations, and the general ledger ensures businesses adhere to such standards and can readily provide any necessary documentation. Transparent financial reporting instills confidence among investors, creditors, and other business stakeholders. It’s a testament to the business’s commitment to accountability and ethical financial management.

3 General Ledger Challenges

While its significance is undeniable, the management of a GL is not without its challenges. In an ever-evolving business landscape, finance professionals grapple with a range of obstacles that can affect the accuracy and reliability of this crucial accounting tool. This section offers an in-depth exploration of the predominant challenges in GL management:

- Human errors and oversight: Even the most diligent professionals are susceptible to human error. Mistyped figures, omitted entries, or misclassified transactions can compromise the integrity of the ledger. Regular reviews and reconciliations are part and parcel of GL management. However, overlooking anomalies or misinterpreting data can lead to financial discrepancies.

- Complex transactions and accounting standards: Accounting standards, both domestic and international, are continuously evolving. Staying abreast of these changes and ensuring the GL aligns with them can be challenging. Certain transactions, like mergers, acquisitions, or foreign exchange, can be intricate. Properly accounting for such complexities in the GL demands expertise and meticulous attention to detail.

- Potential for fraud and misuse: Unfortunately, the possibility of internal fraud, be it through manipulated entries or unauthorized transactions, is a real concern. Such actions can distort the GL’s accuracy and erode stakeholder trust. Inadequate security protocols or access controls can leave the GL vulnerable to external threats and misuse.

Navigating the challenges of managing a general ledger requires a blend of expertise, vigilance, and technological support. By recognizing and addressing these potential pitfalls proactively, organizations can safeguard the integrity of their financial records, ensuring that the GL remains a dependable pillar of their financial architecture.

Basic General Ledger Example

General ledgers are based on double-entry bookkeeping, where each transaction is recorded as both a debit and a credit; this method minimizes accounting errors by logging every financial transaction twice and checking that these accounts always equal one another.

A basic journal entry post to the general ledger for a $100 transaction for office supplies would look like this:

| Date | GL account type |

GL account name |

GL account number |

Debit | Credit |

|---|---|---|---|---|---|

| Feb. 1 | Expense | Office supplies | #5000 | $100 | |

| Feb. 1 | Asset | Checking | #1000 | $100 |

Blockchain and Decentralized Ledgers

Many businesses are implementing blockchain technology into their ledgers to create distributed, transparent, and immutable records for all financial transactions. Unlike conventional ledgers that are centrally maintained by one user or department, blockchain-based ledgers distribute identical copies across multiple computers or nodes in a network, where each transaction is validated and permanently stored. This creates an unalterable record that all authorized parties can access and trust, reducing reconciliation errors and discrepancies.

Blockchain ledgers enhance transaction security through advanced cryptography, enabling smart contracts that automatically execute when predetermined conditions are met. However, companies should carefully evaluate whether blockchain technology aligns with their needs, as implementation typically requires significant technical expertise and changes to existing accounting processes.

General Ledger Best Practices

To maintain an accurate general ledger, businesses need a systematic approach that follows established procedures. Let’s explore five best practices companies can implement to manage their general ledgers.

- Establish and document clear accounting procedures: Well-documented procedures enforce consistency across financial teams. Create comprehensive documentation that outlines standardized processes for recording transactions, reconciling accounts, and reviewing entries. These resources also create indirect benefits by providing valuable references for both training new staff and conducting audits.

- Record entries in the correct accounting period: Timing is crucial in accounting. Therefore, businesses must record all transactions in the period they occur and establish a clear cut-off date for each accounting period. This practice maintains consistent and accurate financial statements for comparative analysis and minimizes period-end adjustments.

- Reconcile regularly: Don’t wait until financial close to check for discrepancies. Implement a regular reconciliation schedule for all accounts, with more frequent reviews for high-volume or important areas, such as cash or accounts receivable. Regular reconciliation helps staff identify and resolve issues before they compound into larger problems.

- Automate recurring or basic entries: Automation not only saves time but also reduces errors and creates consistency across routine accounting tasks. Use software with built-in accounting tools that automate standard, repetitive transactions, such as monthly depreciation entries or recurring bills.

- Leverage accounting software and reporting tools: Modern accounting software streamlines general ledger management through real-time reporting, automated validation tools, and integrated audit trails. After implementation, train staff to take full advantage of all relevant features to improve accuracy and efficiency while maintaining strong quality and security standards.

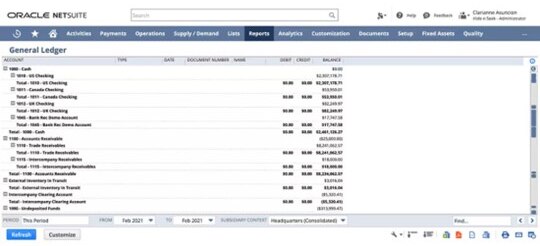

Using NetSuite’s Accounting Software with General Ledgers

Most businesses use accounting software to automate the basic processes around creating transactions and posting them to the general ledger. NetSuite’s general ledger software helps the accounting team perform accounting tasks, such as setting up and closing accounting periods, banking tasks, journal entries, and more. The system will automatically calculate debits and credits and allow you to put controls in place to make sure transactions can’t be entered that don’t meet guidelines.

NetSuite’s General Ledger Software

NetSuite’s accounting software maintains all financial information and records in a single database, which guarantees data integrity, helps establish and maintain controls, and makes the reconciliation process significantly faster and easier. This includes the ability to create recurring entries and allocations, run posting, reporting, translation, and consolidation processes in parallel to speed up reporting time.

A well-maintained general ledger does more than just keep records, it creates a foundation for comprehensive financial management. By implementing robust accounting procedures and modern software, accounting teams can create dynamic general ledgers that provide real-time insights into financial performance. Whether preparing for audits or planning growth initiatives, an accurate and efficiently managed general ledger helps businesses maintain financial transparency that supports data-driven decisions and long-term success.

#1 Cloud

Accounting

Software

General Ledger FAQs

What is a chart of accounts?

A chart of accounts (CoA) is a comprehensive list of all financial accounts used to record and categorize a company’s financial transactions in its general ledger. The CoA serves as an organizational tool that helps businesses track and classify their financial activities across five main account types: assets, liabilities, equity, revenue, and expenses.

What’s the difference between a journal and a ledger?

A journal entry is a recording of an individual transaction. The general ledger summarizes transaction totals by account type (assets, liabilities, equity, revenue, or expenses).

What Is included in a general ledger?

The general ledger is the central repository of all financial transactions. Each entry includes the date, a description of the transaction, the general ledger code to post the journal entry to a specific account, the amount debited and credited, and the balance.

What is the general ledger process?

The general ledger process comprises the following steps:

- Set up the general ledger according to the company’s chart of accounts.

- Create a journal entry for each business transaction as it occurs.

- Categorize each transaction under the relevant account: assets, liabilities, equity, revenue, or expenses.

- Reconcile information to make sure debits equal credits.

- Transfer journal entries to the general ledger as they’re verified.

What does a general ledger tell you?

The general ledger provides a summary of the financial health of the business. Its contents are used to generate financial statements—with liabilities, equity, and assets being reflected on the balance sheet and revenue and expenses on the income statement.

What is a GL code?

A general ledger (GL) code is a unique alphanumeric identifier assigned to specific financial transactions within a business’s accounting system. GL codes categorize and organize entries in the general ledger, facilitating accurate tracking, reporting, and analysis of a company’s financial activities.