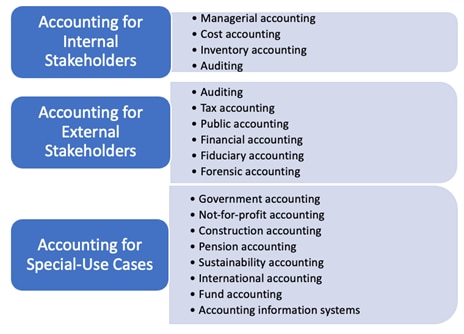

The term “accounting” is often associated with the recording of a company’s financial transactions and tax preparation. But that’s only part of the picture: There are many types of accounting that concentrate on specific financial disciplines, organizational needs, and a company’s unique costs for creating products and services. Some types look at past financial results, while others are used for forecasting. And some accounting is not financial at all, focusing instead on environmental, social, and governance (ESG) reporting.

Recipients of accounting documents and reports vary, too. Some reports are prepared for internal purposes only, used by the business’ leaders to inform their decisions. Others are for public review, prepared for regulatory agencies, potential investors, and even customers. Here we take an in-depth look at the various types of accounting and why each one is important.

What Are the Types of Accounting?

Accounting includes many areas of specializations, each responsible for a different part of a company’s overall accounting posture. Among them:

- Managerial accounting

- Cost accounting

- Inventory accounting

- Auditing

- Tax accounting

- Public accounting

- Financial accounting

- Fiduciary accounting

- Forensic accounting

- Government accounting

- Not-for-profit accounting

- Construction accounting

- Pension accounting

- Sustainability accounting

- International accounting

- Fund accounting

- Accounting information systems

17 Types of Accounting

The following is a description of the main types of accounting. Each entry looks at the key accounting processes covered, its purpose, and types of financial information and accounting standards that apply, along with the primary audience for the resulting financial documents.

1. Managerial Accounting

Managerial accounting is the preparation and distribution of financial documents for internal stakeholders only. Managerial accounting is used primarily for future-oriented internal decision-making, including budgeting, forecasting , as well as for all kinds of analysis, such as cost-volume-profit analysis and variance analysis. Because managerial accounting documents are not publicly released, they can be tailored to a company’s needs and do not need to comply with Generally Accepted Accounting Principles (GAAP) set by the Financial Accounting Standards Board (FASB). Still, the goal is for everything to be accurate and prepared in an ethical and useful manner.

2. Cost Accounting

Cost accounting focuses on a company’s production costs—what it spends to provide its goods and services, including costs for materials, labor, and overhead. A form of managerial accounting, cost accounting analyzes the company’s historical data on fixed and variable costs of making a product, plus the gross profit earned from sales. It also helps companies create budgets for similar projects in the future and identify opportunities to fine-tune cost management and set prices. Cost accounting is most commonly used in industries such as manufacturing, which require substantial investments in labor and capital to make their products.

3. Inventory Accounting

Inventory accounting examines the value of a company’s inventory, which consists of raw materials, works in progress, and finished goods ready for sale. Inventory accounting assigns a value to each item in its specific stage of production in accordance with the company’s inventory valuation methodology. In addition, inventory accounting tracks changes in inventory value due to factors such as write-downs or write-offs, obsolescence, and changes in supply and demand. GAAP applies to inventory accounting to ensure that companies accurately state inventory value, which affects a company’s overall net worth and profitability.

4. Auditing

Internal auditing is an in-house role that establishes internal accounting policies and procedures with the goal of improving risk management, governance, and process-control operations. Internal auditors often serve as consultants to management, helping to correct flawed processes; identify and mitigate instances of fraud, waste, and abuse; and prevent future cases of mismanagement of funds prior to an external audit. In some cases, publicly traded companies or government agencies may require internal auditors to obtain accreditation as a Certified Internal Auditor.

External auditing is the process through which an external, independent certified public accountant (CPA) reviews the company’s accounting records and prepares a detailed report of the findings. Auditors may be called on to verify a business’s compliance with internal or regulatory standards, investigate suspicious financial activity, analyze the accuracy of financial statements, or review tax returns. External audit engagements must adhere to Generally Accepted Auditing Standards (GAAS).

5. Tax Accounting

Tax accounting focuses on the preparation of annual company tax returns, for which revenue and expenses must be recorded and reported in accordance with the Internal Revenue Code. Tax accounting also includes tax planning, which identifies opportunities to legally reduce a company’s future tax burden. Additionally, specialized tax accountants may be charged with analyzing any business decisions related to federal, state, local, transfer, sales, payroll, and property taxation.

6. Public Accounting

Public accounting refers to accounting firms that work with public, private, and nonprofit organizations, as well as individuals. Services include tax preparation, auditing, bookkeeping, and the preparation of financial statements. Many public accounting firms also offer consulting services that focus on business strategy, mergers, and acquisitions, and the use of accounting information systems. Deloitte, PwC, EY, and KPMG—known as the “Big Four”—lead the space, though many other public accounting firms operate on a local, national, and international scale. Public accountants have a duty of independence and are regulated by the Public Company Accounting Oversight Board in the United States.

7. Financial Accounting

Financial accounting records financial transactions and assembles standardized financial statements that external stakeholders—such as creditors, lenders, investors, and members of the public—may use to evaluate a company’s financial strength. Financial accounting documents include, but are not limited to, balance sheets, income statements, and statements of cash flow. These documents should be prepared in accordance with GAAP, or its international counterpart, International Financial Reporting Standards (IFRS). Public companies also need to follow regulations set by the Securities and Exchange Commission.

8. Fiduciary Accounting

Fiduciary accounting is the management of accounts and activities related to the administration of a business’s property, such as pensions, trusts, endowments, and investments. Fiduciary duty—the legal obligation to act in the best interest of another party—is the foundation of fiduciary accounting. Fiduciary accounting documents all disbursements made by the executor of a trust, estate, guardian, or conservatorship; it also allocates all transactions between principal and income. In addition, fiduciary accounting plays a key role in receivership, which occurs when bankruptcy or a similar event requires the appointment of a custodian of business assets.

9. Forensic Accounting

Forensic accounting focuses on legal inquiries into fraud, embezzlement, financial disputes, and claims resolution. The term “forensics” applies because accountants are often called on to recreate or reconstruct incomplete or fraudulent financial records. Those in forensic accounting roles often serve as auditors or consultants hired as needed by banks, law enforcement agencies, attorneys, and businesses. Forensic accountants also play a role in preventing fraud by helping organizations design and implement internal controls.

10. Government Accounting

Government accounting in the United States tracks income and expenses at government entities at the federal, state, and local levels, per guidelines set by the Governmental Accounting Standards Board (GASB) and the Federal Accounting Standards Advisory Board. Using specialized fund accounting, projects are tracked in separate funds, designed to maintain tight control over resource inflows and outflows and accurately report on how public money is being spent. Projects typically fall into one of five types of government funds: general, permanent, special revenue, capital projects, and debt services. Some international governments adhere to International Public Sector Accounting Standards, but these standards are not universally adopted, and many countries continue to use their own national or organizational accounting standards for the public sector.

11. Not-for-Profit Accounting

Not-for-profit accounting makes sure organizations use their resources in line with their charitable missions to maintain their tax-exempt and not-for-profit status, as framed by the IRS. This involves several steps not required of for-profit or government entities, including tracking funding sources, accounting for any restrictions placed on donors’ contributions, labeling net assets, reporting functional expenses, and disclosing specific details about program services, fundraising, and administrative costs. While GAAP rules apply to not-for-profit accounting, they report unique financial statements, including the Statement of Financial Position (such as a balance sheet), Statement of Activities (such as an income statement), Statement of Cash Flows, and Statement of Functional Expenses.

12. Construction Accounting

Construction accounting addresses the industry’s distinct requirements for contractors for project-based work that may span several accounting periods. This time element can make revenue recognition and tax reporting difficult, as expenses may be incurred in one accounting period while revenue is earned in another. Specialized revenue recognition methods, such as the percentage-of-completion or completed-contract method, are prevalent in construction accounting, as are other unique elements such as progress billing, retainage, and specialized financial reports like the Work-in-Progress schedule.

Best practices for construction accounting call for accurate job-costing, change-order management, and choosing the right revenue recognition method—all of which can cut into a construction company’s profits if not properly handled.

13. Pension Accounting

Pension accounting is the calculation and disclosure of a pension plan’s assets and liabilities in a company’s financial statements. Pension accounting principles require costs to be recognized in a specific manner to tie the value of the benefits to an employee’s time with an organization. The FASB governs pension accounting under GAAP in the United States. Pension accounting also takes into consideration past and current service costs, the impact of interest, and expected income from plan assets, such as investment interest, dividends, and capital gains. Pension accounting differs significantly between defined benefit (traditional pension plans) and defined contribution plans (401(k) plan), with defined benefit plans relying on complex actuarial assumptions about future events.

14. Sustainability Accounting

Sustainability accounting is an emerging form of nonfinancial accounting that measures and reports a company’s ESG impacts. Sustainability accounting includes metrics, such as carbon emissions, water usage, workforce diversity, and board independence. This information may be of interest to potential investors, or it may fulfill government reporting requirements or demonstrate a commitment to sustainability to the public. Standards are emerging for how to report on sustainability, and a growing number of public accounting firms now provide assurance and attestation services for ESG reporting.

15. International Accounting

International accounting addresses financial reporting and business operations across national borders. It is the set of accounting principles and practices that are relevant to multinational corporations, cross-border transactions, and international financial markets. The IFRS, developed by the International Accounting Standards Board, is the foundational framework. Unique challenges include foreign currency transactions, transfer pricing, international taxation, and the consolidation of financial statements from subsidiaries in different countries. As global business continues to expand, the role of international accounting has become increasingly important for ensuring transparency, comparability, and reliability. A key focus of international accounting is understanding and reconciling the differences in accounting standards, practices, and regulations among various countries.

16. Fund Accounting

Fund accounting is a specialized system for organizing financial transactions for government and nonprofit entities. Each fund has a separate ledger to track assets, liabilities, equity, revenue, and expenses for a particular program. Financial statements can be run for each fund, making it easy to track how money is spent in accordance with any legal, regulatory, or donor-imposed requirements. Government entities follow GASB standards for fund accounting, segregating tax-supported activities. Common government funds include those for capital projects, debt service, general spending, and specialized projects. Nonprofits adhere to FASB Accounting Standards Update 2016-14 and classify funds based on the nature of their donors’ restrictions, generally using two types of funds: net assets with donor restrictions and net assets without donor restrictions.

17. Accounting Information Systems

Accounting information systems (AIS) are the intersection of technology and accounting, rather than a distinct type of accounting. AIS refers to the systems and processes a business uses to collect, store, manage, process, retrieve, and report its financial data, and encompasses the hardware, software, and people involved. Beyond manual and legacy computer systems, current AIS include cloud-based accounting systems and enterprise resource planning (ERP) systems. More advanced AIS integrate with other business functions, such as human resources and procurement. Using AIS improves the accuracy and reliability of accounting data, while also keeping it timelier and more accessible. AIS are also integral for the control environment, helping businesses maintain compliance with regulations and prevent or detect fraud.

What Do All Types of Accounting Have in Common?

No matter the type of accounting, all methods share several characteristics. First and foremost, all accounting strives for accuracy. Invoices, financial documents, tax returns, and reports to government regulators or investigators must be factual. Any error can have a negative impact on an organization’s financial future—and its reputation.

In addition, all types of accounting should strive to adhere to industry standards and best practices. For example, the GASB regulates government accounting processes, while the FASB sets the guidelines for GAAP. The Internal Revenue Code lays out the rules for individual and institutional taxpayers, and the American Institute of Certified Public Accountants establishes GAAS. These standards help ensure consistency and accuracy in financial reporting.

All types of accounting are also best served by modern accounting and financial management software that simplifies and/or automates the many core processes and calculations inherent to the discipline. Additional capabilities should include the consolidation of a business’s financial data in one place and the ability to disseminate resulting reports and documentation to internal and external stakeholders.

Find the Right Accounting Method for Your Business

Just as businesses are unique, so are their accounting needs. No matter which type of accounting your business follows, having the right software can make all the difference. NetSuite cloud accounting software provides features to support any accounting requirements. Its flexible structure and customizable chart of accounts give the accounting and finance team the ability to set up reports and segments that reflect their business and the type of accounting they use.

Managing multiple accounting methods, currencies, and tax structures can be complex, but NetSuite simplifies it all by using prebuilt mapping capabilities that link primary and secondary charts of accounts and book-specific functional currencies, including revenue recognition, expense amortization, depreciation, and allocations. Powered by artificial intelligence, NetSuite eliminates wasted time and resources from manual processes and ensures that standards are consistently applied in a scalable way while integrating with other modules within the ERP system.

There are many different types of accounting, and each plays a key role in helping to manage the finances and operations of a business, not-for-profit organization, or government entity. Some types of accounting focus on creating financial documents for internal use, other types focus on financial information of interest to external stakeholders, and still others are highly specialized due to their focus on a particular industry or type of financial account. All, however, demand the highest levels of accuracy, as well as compliance with various accounting standards and regulations.

#1 Cloud

Accounting Software

Types of Accounting FAQs

What is the definition of accounting?

Accounting is the process of recording, tracking, and analyzing a company’s financial transactions—revenue, expenses, assets, liabilities, and equity—and aggregating the information into various financial reports prepared for internal and external stakeholders. The standard reports that accountants produce include balance sheets, income and cash flow statements, and tax returns.

What are the main types of accounting?

Four main types of accounting are managerial, cost, tax, and financial. Managerial accounting is the preparation and distribution of financial documents for internal stakeholders only, used primarily for budgeting, analysis, and forecasting purposes. Cost accounting is a form of managerial accounting that focuses on what a company spends to create its goods and services. Tax accounting focuses on the preparation of annual tax returns and tax planning. Financial accounting records financial transactions and assembles standardized financial statements that external stakeholders, such as creditors, lenders, investors, and members of the general public, may use to evaluate a company’s financial strength.

What are Generally Accepted Accounting Principles?

Generally Accepted Accounting Principles (GAAP) are a set of accounting standards and guidelines established by the Financial Accounting Standards Board. These principles ensure a transparent accounting process and provide standards for terminology, definitions, and methodologies. When companies comply with GAAP, it’s possible for external stakeholders to accurately compare financial statements across entities. GAAP compliance is mandatory for public companies in the United States, but many private companies also adopt the principles as general accounting best practices.